Import from the USA

PACK & SEND carry out deliveries to and from the USA every day of the year. We specialise in transporting large, awkward, fragile and valuable goods. That’s why we’re your perfect partner for all your import needs. We examine all the things you need to consider when importing goods from the USA, from paperwork requirements to customs duties and taxes.

If you want to get an estimate for handling your import from the USA now then simply complete the form here.

Paperwork Needed for Importing from the USA

When preparing to import to the UK from the USA, you’ll need to prepare the following:

- Customs declaration – this is a document that gives the details of the goods you are importing. It can be lodged either by you or your broker or freight forwarder.

- Commodity code – this is a ten-digit number that classifies imports from outside the EU. It identifies the rates of duty and VAT you’ll pay and any restrictions there are on your items.

- EORI number – this is a registration and identification number for anyone importing goods into the UK.

- Import licences – this is not needed for the majority of goods, but some do need licences. These include military goods, technology, art, plants, animals, medicines and chemicals.

Import Duties and Taxes USA to the UK

The number of duties and taxes payable on your goods will depend on its commodity code, as well as the overall purchase and shipping value of the shipment.

As the US does not have tariff preferences with the UK, customs duties apply to all goods with a value of over £135. The exact percentage payable depends on the commodity code, which you can check on the Trade Tariff website.

Items will not clear UK customs until all duties and taxes have been paid. Therefore, these are important things to consider to ensure the swift delivery of your imports.

Get a quote

VAT on Imports USA to the UK

Value Added Tax (VAT) also needs to be paid on anything being imported into the UK from the USA. This is calculated on top of import duties and is at the same rate if you had bought the items in the UK – 20%. Importantly, it also includes the door-to-port cost of shipping the items to the UK. It, therefore, doesn’t disadvantage companies far from UK ports.

If your EORI number is linked to your UK VAT number, you can claim back the VAT on your normal VAT return by using HMRC form C79.

You shouldn’t pay American VAT on your goods, as you only need to pay VAT once. If you have paid VAT in the US, it’s very difficult to reclaim it.

Get a quote

Sea or Air Freight from the USA?

For large volumes or flexible delivery times, sea freight is the cheapest option. Sending your shipment by sea will take around 2 weeks from East Coast ports such as New York, Baltimore or Savannah.

From West Coast ports like Long Beach and Los Angeles, sea freight will take about a month, as the shipment will have to traverse the Panama Canal.

If you want things quickly, air freight is the option for you, but it will cost more. Airfreight from the USA is best suited for higher value items or loads under 100kg. Flight times will be under 10 hours, but small shipments as part of a consolidated flight may need to wait to be assigned a plane.

International Shipping

Anything, Anywhere from the USA

The PACK & SEND Difference means that we pride ourselves on shipping strange and unusual items. When a UK buyer was successful in winning an auction at Christie’s in New York he contacted PACK & SEND to have the major canvas collected, crated and air-freighted directly to his London address.

Get a quote

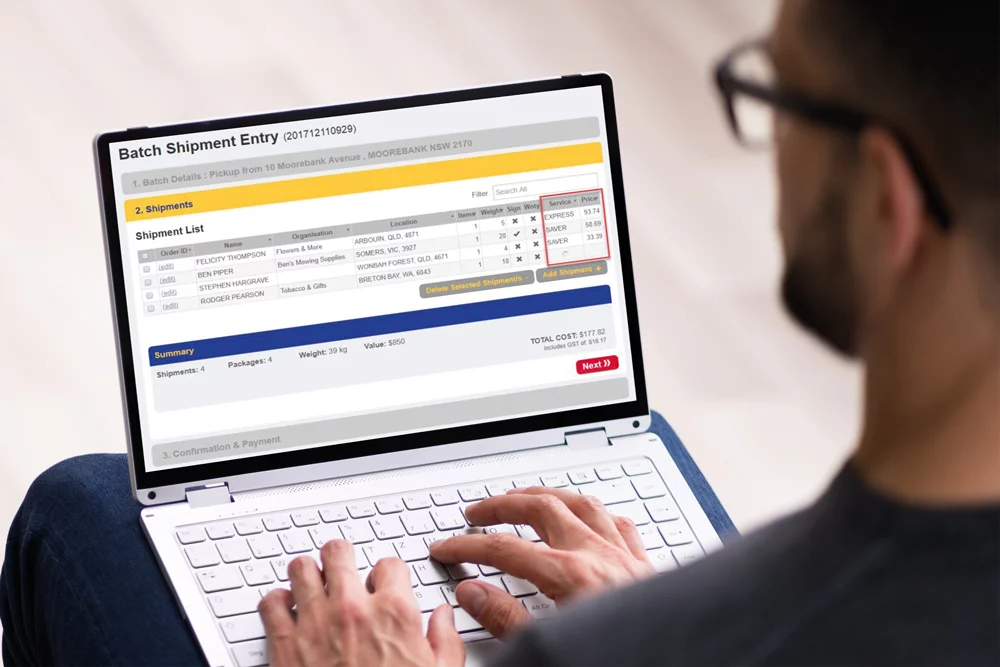

Online Self-Service

This service allows you access to PACK & SEND’s shipping services at a reduced cost to the full service provided by our service centres. As long as your goods are pre-packed and less than 30kg, they might be eligible.

What ways are there to import my goods from the USA?

For shipments being imported from the USA PACK & SEND offer both sea and freight services. More information on these services can be found here – https://www.packsend.co.uk/business-solutions/international-freight-and-shipping/.

What paperwork is required when importing goods from the USA?

Import shipments coming from the USA have some paperwork that will be required. The required paperwork could include; a customs declaration, commodity code, EORI number and an import license. Contact your nearest PACK & SEND service centre to find out we can help you complete the documentation for your import getting it safely to you.

Are there import duties and VAT for imports from the USA?

Customs duties will apply to goods with a value of over £135. As well as this VAT will also be paid on all imports from the USA. This is on top of the customs duties at the same rate as the UK, 20%. If your EORI number is linked to your UK VAT number, you can claim back the VAT on your normal VAT return by using HMRC form C79.