Import from Australia

PACK & SEND frequently carry out deliveries to and from Australia and has done so for over 30 years. We deliver everything you’d think of and some things you wouldn’t. That’s why we’re your perfect import partner. If you want to get an estimate for handling your import from Australia now then simply complete the form here.

Paperwork Needed for Importing from Australia

When preparing to import to the UK from Australia, you’ll need to prepare the following:

- Customs declaration – this is a document that gives the details of the Australian goods you are importing. It can be lodged either by you or your broker or freight forwarder.

- Commodity code – this is a ten-digit number that classifies imports from outside the EU. It identifies the rates of duty and VAT you’ll pay and any restrictions there are on your items.

- EORI number – this is a registration and identification number for anyone importing goods into the UK.

- Import licences – this is not needed for most goods, but some do need licences. These include military goods, technology, art, plants, animals, medicines and chemicals.

Import Duties and Taxes Australia to the UK

The number of duties and taxes payable on your goods from Australia will depend on their commodity codes, as well as the overall purchase and shipping value of the shipment.

As there is currently no free trade agreement between Australia and the UK, customs duties will apply to goods worth over £135. The exact rate will depend on the commodity code of the import in question. You can check the duty rates for each code on the Trade Tariff website.

If you don’t pay any required import duties, customs will hold your goods for about 3 weeks before sending them back. They could even seize your goods, and you may also be fined.

get a quote

VAT on Imports Australia to the UK

Value Added Tax (VAT) also needs to be paid on anything being imported into the UK from Australia. This is calculated on top of import duties and is at the same rate if you had bought the items in the UK – 20%.

Importantly, it also includes the door-to-port cost of shipping the items to the UK. It, therefore, doesn’t disadvantage companies far from UK ports.

If your EORI number is linked to your UK VAT number, you can claim back the VAT on your normal VAT return by using HMRC form C79.

You should make sure you don’t pay Goods and Services Tax (GST), the Australian equivalent of VAT, as VAT is paid in the UK and you only need to pay once. Therefore, you should ensure that your Australian supplier doesn’t charge you GST, as it can be difficult to reclaim it once paid.

Get a quote

Sea or Air Freight from Australia?

This choice depends on how much you’re shipping and how urgently you need it. Sea freight is usually the best option if your shipment is large. However, you shouldn’t use sea freight for urgent items, as your shipment will take around 2 months to reach the UK from the main Australian ports.

If you want your shipment to arrive quickly, air freight is the option for you. Flight times will be around 24 hours, as the plane will need to refuel on the 10,000-mile journey. This usually occurs in Singapore or Dubai.

If your shipment is small, it may take longer to arrive. This is because it will be part of a consolidated flight and may have to wait until a plane is full before departing.

International Shipping

Anything, Anywhere from Australia

The PACK & SEND Difference means that we pride ourselves on shipping strange and unusual items. We’ve recently arranged the sea freight of a 1960s Hawker fighter jet engine from Melbourne, Australia to the UK for an aircraft enthusiast club.

The key to this was ensuring that the loading and crating were completed correctly which we undertook by managing our local agents on the ground.

Get a quote

PACK & SEND Online Self-Service

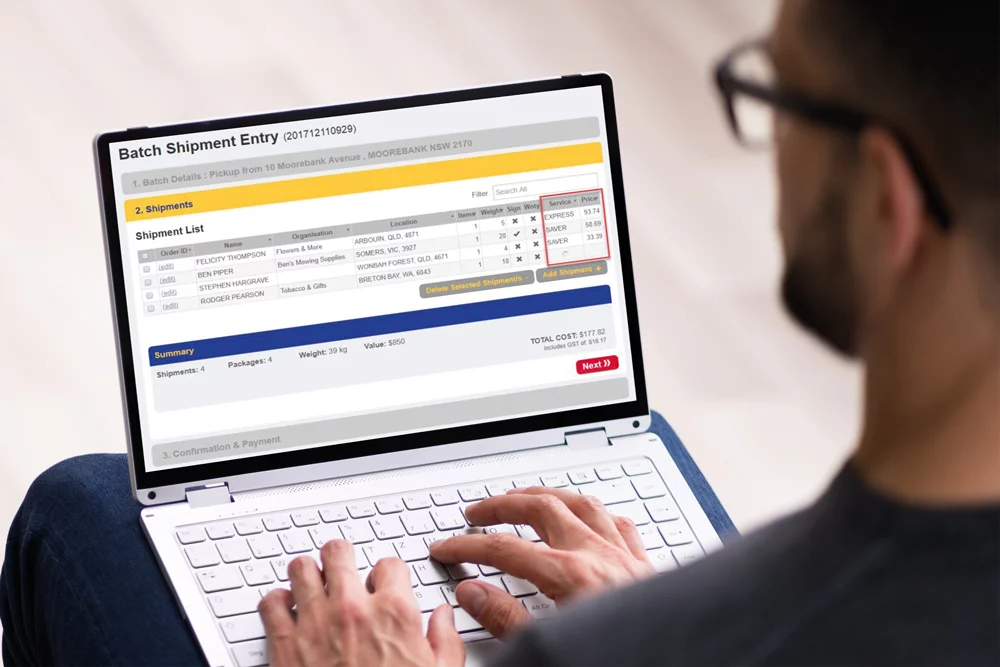

A different method of importing products from Australia is made available to you through PACK & SEND Online Self-Service.

With this service, you may utilise PACK & SEND’s shipping capabilities at a price that is lower than what you would pay for the full service provided in our service centres. Your items may be eligible if your shipment is pre-packaged and weighs less than 30 kg.

By packaging your items, scheduling the shipment, printing the labels, and tracking the cargo all the way through, you get to control the entire shipping process!

Book your shipment here

What ways are there to import my goods from Australia?

When importing your things from Australia there are two methods PACK & SEND can use to transport your goods. We offer both sea and air freight services, for more information about this head here – https://www.packsend.co.uk/business-solutions/international-freight-and-shipping/.

What paperwork is required when importing goods from Australia?

Import shipments coming from Australia have some paperwork that will be required. The required paperwork could include; a customs declaration, commodity code, EORI number and an import license. Contact your nearest PACK & SEND service centre to find out we can help you complete the documentation for your import getting it safely to you.

Are there import duties and VAT for imports from Australia?

Customs duties will apply to goods with a value of over £135. As well as this VAT will also be paid on all imports from Australia. This is on top of the customs duties at the same rate as the UK, 20%. If your EORI number is linked to your UK VAT number, you can claim back the VAT on your normal VAT return by using HMRC form C79.